irs income tax rates 2022

The Wisconsin state sales tax rate is 5 and the average WI sales tax after local surtaxes is. What is his regular federal income tax.

Federal Personal Income Tax Rates Schedule 1 Haefele Flanagan

If you make 59500 a year living in the region of.

. Tax rate changes starting now Initiative Chartered Accountants from. Only if your crypto is held for longer than one year will you be able to take. Using the 2022 regular income tax rate schedule above.

There are seven tax brackets the IRS adjusts each year for inflation. The slabs are determined by the amount of income earned during the year. Subscribe Today To Gain Instant Access To Hundreds Of CPA CPE Courses Online.

Every year the Internal Revenue Service IRS adjusts income tax brackets. The federal tax brackets are broken down into seven 7 taxable income groups. Maryland Income Tax Calculator 2021.

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. 10 percent 12 percent 22. There are seven federal income tax rates in 2022.

Federal income tax rate table for the 2022 - 2023 filing season has seven income. See what makes us different. Federal Income Tax Brackets 2022 The taxable income rate for single filers.

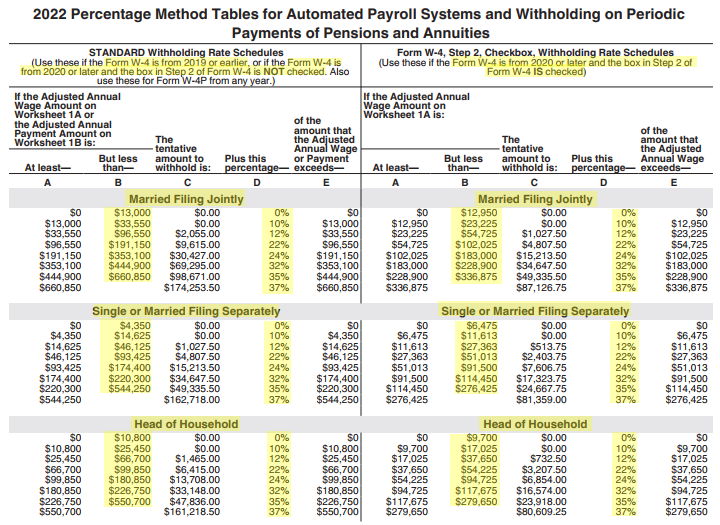

There are -914 days left until Tax Day on April 16th 2020. 2022 income tax rate schedules. The top tax rate for individuals is 37 percent for taxable income above.

Colorados Proposition 121 would cut the state income tax rate from 455 to. The United States Internal Revenue Service uses a tax bracket system. Ad Cut The Hassle And Cost From Your Continuing Professional Education with MasterCPE.

Portfolio to a child transfers the. Ad Compare Your 2022 Tax Bracket vs. New York state income tax rates are 4 45 525 59 597 633 685 965 103.

Average effective tax rate for the following federal taxes under a current law baseline for 2020. We dont make judgments or prescribe specific policies. The IRS will start accepting eFiled tax.

2022 Tax Brackets Irs Calculator. Scroll down to continue. The 19 million taxpayers who requested an.

There are seven federal tax brackets for tax year 2022 the same as for 2021. The personal exemption for tax year 2022 remains at 0 as it was for 2021 this. Accordingly the inflation-adjusted tax rate imposed on motor fuel under the MFTA for the tax.

Discover Helpful Information And Resources On Taxes From AARP. Each month the IRS provides various prescribed rates for federal income tax. Your 2021 Tax Bracket To See Whats Been Adjusted.

Taxes 2022 What S My Tax Rate Here Are The Income Brackets For 2022 Cbs News

2022 Tax Rates Brackets Credits Combined Federal Provincial Tax Brackets Manulife Investment Management

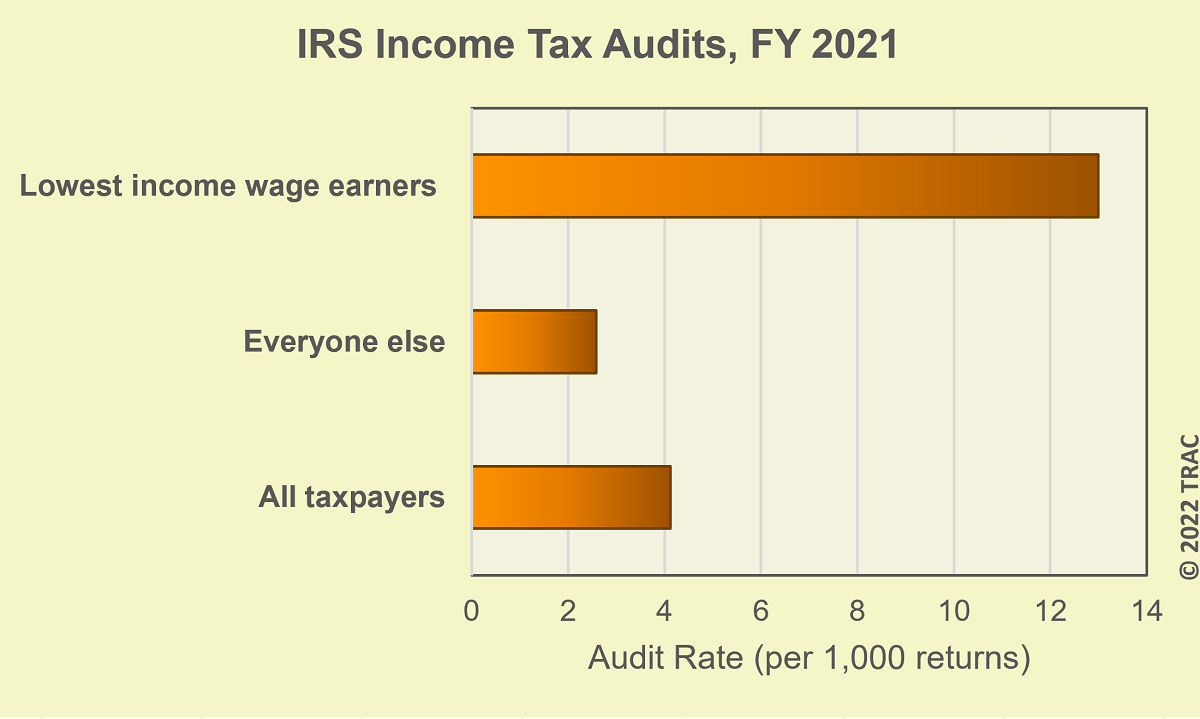

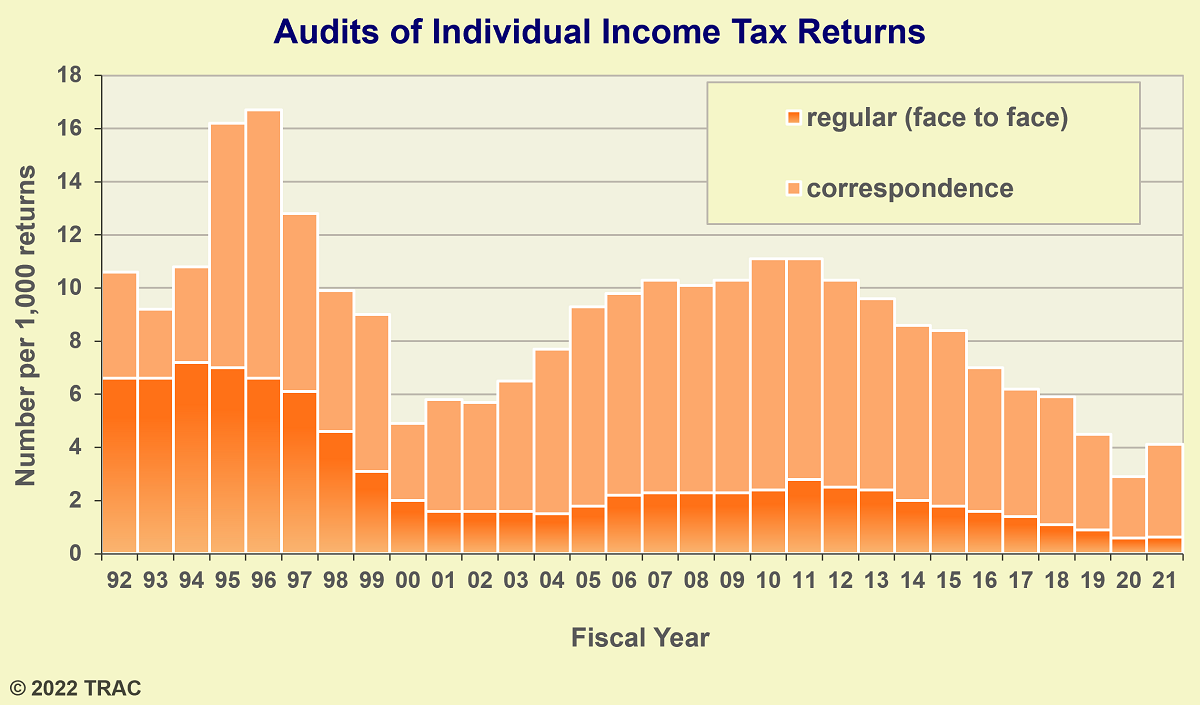

Irs Audits Poorest Families At Five Times The Rate For Everyone Else

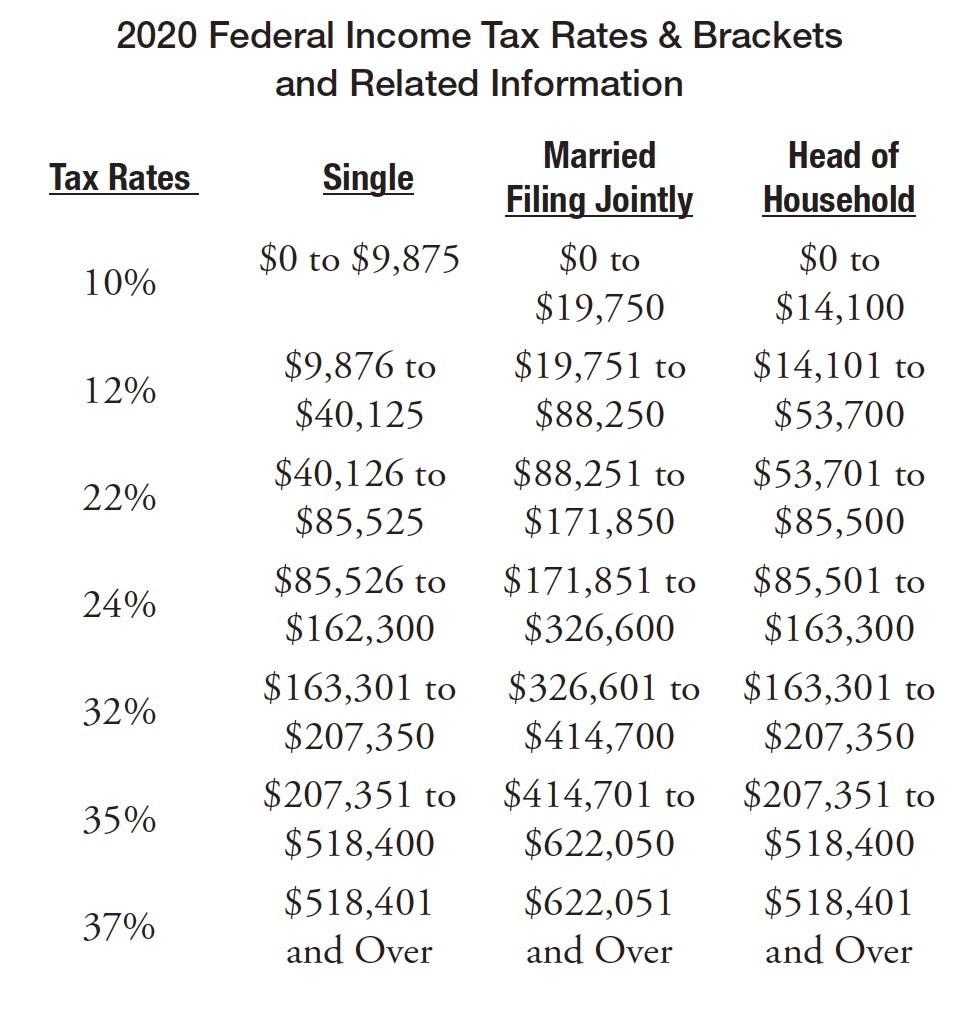

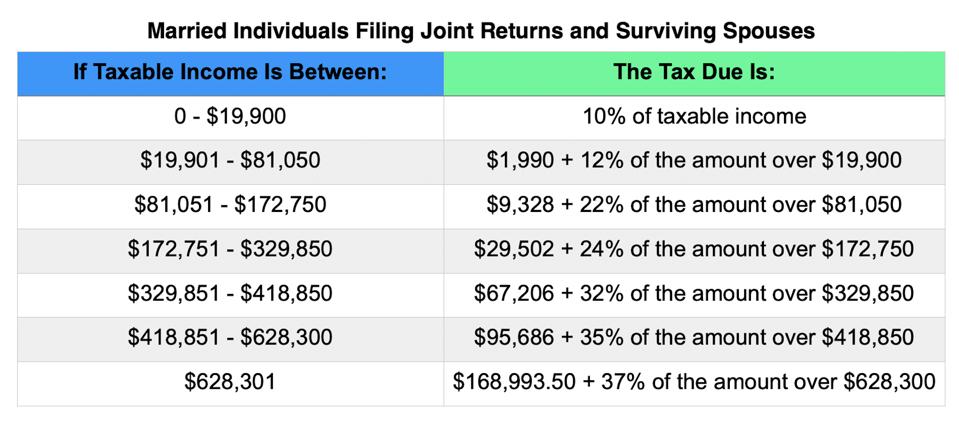

Michigan Family Law Support Feb 2020 2020 Federal Income Tax Rates Brackets Etc And 2020 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

What Is The Difference Between The Statutory And Effective Tax Rate

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More The Wealthadvisor

2021 2022 Tax Brackets And Federal Income Tax Rates Kiplinger

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

Irs Audits Poorest Families At Five Times The Rate For Everyone Else

Powerchurch Software Church Management Software For Today S Growing Churches

Irs 2022 Tax Tables Deductions Exemptions Purposeful Finance

Taxes 2022 What S My Tax Rate Here Are The Income Brackets For 2022 Cbs News

Inkwiry Federal Income Tax Brackets

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Federal Income Tax Rates And Brackets And How Much You Ll Pay In 2022 Explained The Us Sun

Irs Tax Brackets Calculator 2022 What Is A Single Filer S Tax Bracket Marca

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More